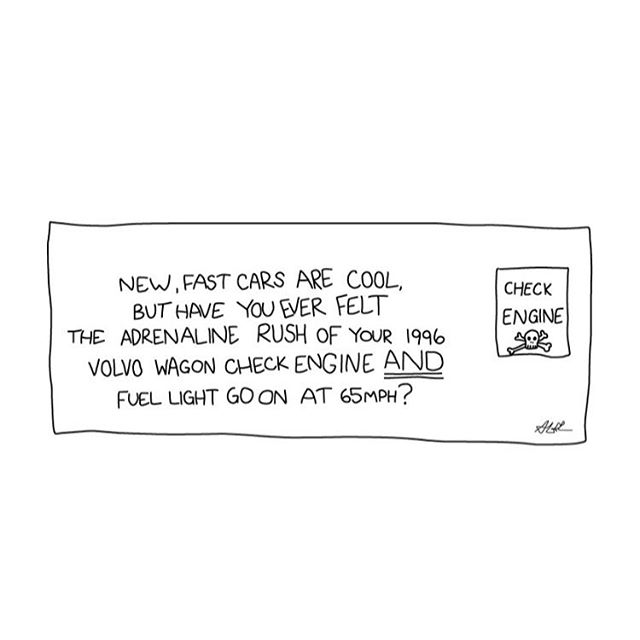

I don’t like to boast, but one thing I do like to brag about (when the opportunity presents itself) is that I paid off my $35,000+ student loan debt before I turned 25. It was mostly for undergrad since I got a assistantship when I was in Graduate School. Paying my debt is something I’m very proud of and it required a lot of sacrifice. I didn’t get to live with my parents, or throw it in cruise control with other people paying my bills. Sometimes I read these stories about people paying their student loans and there’s all these caveats that are total garbage. Like, your grandpa Joe dying and leaving you his estate doesn’t count as ‘struggling’ to pay student loans. If anything he is happy in heaven knowing that he helped you out in life. I’m only half kidding here because I was always very envious of these types of people who had it a little bit easier than me. But that’s how life goes. The sooner you accept life is unfair and you have to make the best of your hand, the more empowered you feel and radiate like the bad bitch you are. For me, I wasn’t balling on a budget because my budget was my living expenses and the rest of my ancillary funds went to my debt. I picked up extra jobs, flipped furniture on Craigslist, I LIVED the hustle and I lived in well below my means and pinched EVERY PENNY. I was often ostracized by my peers for being frugal and cheap, but its all good. I realized that they were too far removed from the debilitating reality of debt and far more concerned about whether Burnette’s was in the jungle juice at the PIKE frat house. And no, it was always Aristocrat because Burnette’s was for that rich college blood.

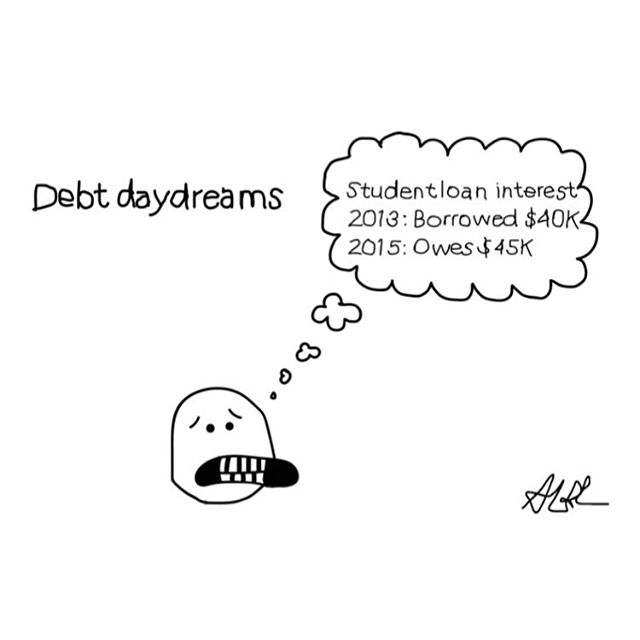

I’ll be writing a future post on how I paid my student loans step by step, but the important task I figured out my 2nd year of college was: 1.) how much I owed and 2.) who I owed. These are two crucial things you need to know ASAP. I did NOT wait until I graduated from college with a job lined up. START THINKING ABOUT PAYING YOUR DEBT AS SOON AS YOU CAN. I started my Sophomore year. One day it just hit me and I asked myself… so all this money I borrowed- what’s up with that? Like, when you think about it in simple terms, here it is: some bank/entity lent you a very large sum of money to go to school and you can’t even remember their name? Or where to get in touch with them? I didn’t rage my face off and do (many) keg stands before I figured out I needed to get my bills in order so I wasn’t stricken with debt for the rest of my life. Debt is stressful af. I get it. But its kind of like a muscle. You feel weak looking at the principal due but the more you look at it, and take charge, the easier it gets. When I opened my first loan letter and started paying down my payments at age 20, I paid $850 my first year in INTEREST. Ouch. It was a tough pill to swallow but I can swallow pills now, not when i’m old and wrinkly and still haunted with an outstanding balance.

You can find out how many Federal Loans you have by looking at your FAFSA (Free Application for Federal Student Aid) login at studentloans.gov. It will be a painful process at start so make sure you have a pen, some paper, and a bottle of wine. Maybe a tissue box. Make sure your phone is charged in case you need to phone a friend and cry. Yeah, its money you borrowed - get over it you baby and start getting on with paying it back. It’s pretty straight forward and each entry will list who services the loan (FedLoan, Navient, and Great Lakes to name a few). If you’re still in a pickle, you can go to the mothership aka the National Student Loan Data System at NSLDS.ed.gov where you can find every student loan you took since the dawn of time. Log on, print those lists, and then vet them with your university. THE FOLLOWING IS A VERY IMPORTANT STEP: make sure you vet what you lended with your University student loan office. When I went through my student loans I reviewed the NSLDS list with the list of loans my university said I borrowed and I found an extra $1,000 loan that I NEVER RECEIVED. I argued it and showed them the proof of the information via NSLDS and the university removed it from my account. I believe they said I received an additional Perkins - it was never deposited or provided to the university. I was able to catch the correction because I was good at addition and was working towards paying the least amount for college as possible…. But think about HOW MANY PEOPLE NEVER CAUGHT IT. I couldn’t have been the only person! The university said it was a ‘glitch’ which was totally insane because it was $1,000, a grand, a big K… not a rounding error at the cash register at a gd Denny’s.

For reference, types of Federal Loans include:

Stafford Loans (subsidized or unsubsidized)

The next step where you need to gird your loins is finding your private student loans. Fortunately I only had one of these for $4,500 and it was the FIRST one I paid off with Discover. It changed a few hands while I had it and I constantly had to be creating new log ins for new websites with new payment methods and fees. But I paid off that motherfucker so who’s the king now!!

If you have no idea who to touch base with regarding your private loans, go to your university Bursar Office or Admissions - aka the department at your university that’s responsible for disbursing loan funds. Feeling like you’re lost? Jesus you borrowed all that money so this place could help you - call your university’s general information line if you have to for christ sake. Just get that info before you get swamped in midterms or tied up in writing your thesis or whatever. The Bursar/Admissions Office will help you. If they say they can’t, they are liars and call again or go to the Dean of Students and fight until you get the information. Its your money and you need to figure out who you owe. If you’re at wits end, we have the technology! As a last resort you can go to annualcreditreport.com and then moving forward in your college career, keep track of this however you can - paper trail, excel spreadsheets, tie a gd string around your finger. Pay the piper because the sooner you pony up the sooner you are free to live in a van like you always wanted to because, honestly, who can afford a house after paying student loan debt?

Next is finding out what you owe. There are two components to this piece is keeping a gd folder and paper trail with your payments towards principal and interest. Your principal is how much you borrowed on day 1. Your current amount/balance is your principal+interest. When you make a payment toward your loan, you should be able to tell how much you’re paying towards interest and principal. When you make a payment these days, it should even show you the breakdown. If you know the starting principal amount, interest rate, and current balance amount you can better plan, budget, and pay that sucker off.

Now here’s where people start acting dumb. They figure everything is on auto pay so they’ll just pay the minimum balance. NO. WRONG. If you let it autopay, it will base your payments on a longer term plan, like a 10-year loan repayment plan. That means if you borrowed at 20 that means you don’t pay them back until you’re 30. Thats a long ass time to still have someone from your past lingering around and suckling from the teat of your bank account. If you can swing it by picking up side hustles, make frequent payments as much as you can. I would make payments on my loans every pay cycle, or every two weeks to catch up with interest. By the end of my senior year I’m pretty sure I paid off all my unsubsidized loans and was paying straight principal like a boss through graduate school. WAIT BUT WHAT’S THE DIFFERENCE you may ask. If you’ve stopped being a punk and have completed all of the steps so far, read on:

A loan that is already accruing interest, its an unsubsidized loan. They can be Federal Loans or Private loans. Pay those bitches off first because they keep getting bigger and bigger like that girl from Willy Wonka only you can’t bring her to the juicer. A direct subsidized loan is one typically where the loan interest doesn’t kick in until after you graduate or a grace period (a period of time) after you get that very expensive piece of paper.

Now, for those folks that are so wrapped up in academics that they can’t pick up side hustle work like cleaning bathrooms or making sandwiches, there’s hope. There’s a few options out there that can help. For these plans its important to contact your lender and make sure you’re square to have an alternate payment cycle, but if you can swing it, check out:

Income-Based Repayment Plan (IBR)

Income-Contingent Repayment Plan (ICR)

Pay as You Earn (PAYE)

Revised Pay as You Earn (RPAYE)

What you need to figure out though is if you make a smaller payment, are you shitting on yourself in the long run - aka are you going to owe more for the life of the payment term? The goal here is to owe the least amount of money possible and ideally just what you borrowed (no more!). Get the details, get the info, and get your shit together. For private loans, beware of some of the loan language and obligatory interest.

Now its crunch time! Every day you wait you will owe more and more. The way compounding interest works is that the interest accrues on your total balance. Although its challenging and easy to put those letters from Navient to the wayside, get a grip on what you owe now so you’re not kicking yourself later.